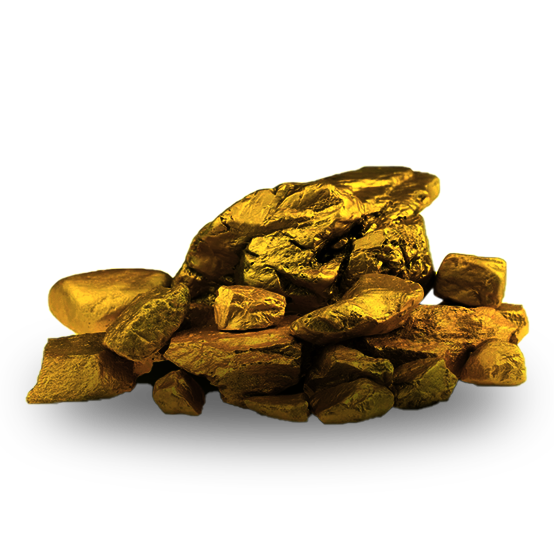

We're as good as gold at buying gold

The Golden Swann offers reasonable payouts and expertise to buy your jewelry as well as anything else you may have related to gold, silver, bullion and coins.

Coins

Old Gold

Gold & Silver Jewelry

For over 40 years, the Golden Swann’s humble little shop has been a unique showcase of precious metals, designer collectibles, and custom jewelry. We deal exclusively in buying and selling of bullion, gold or silver that is delivered directly to your door.

An Easy Process.

3 Simple Steps.

Step 1

Bring your coins, bullion, and jewelry pieces to our Auburn, CA store.

Step 2

We will evaluate your items, weight them and give you an estimate.

Step 3

We make an offer for your items and pay your check or cash on the spot.

Why Invest in Gold?

Gold has maintained its value over time, and people view it as a means of preserving and passing on wealth from one generation to the next.

When the US dollar or the reserve currency declines, gold prices climb. For this reason, gold has been dubbed the safe haven. When the value of the reserve currency drops, people begin to swarm to gold as a security.